Categories

Moving to Phoenix?Published January 6, 2026

2026 Phoenix Housing Forecast: What Buyers, Sellers, and Investors Need to Know

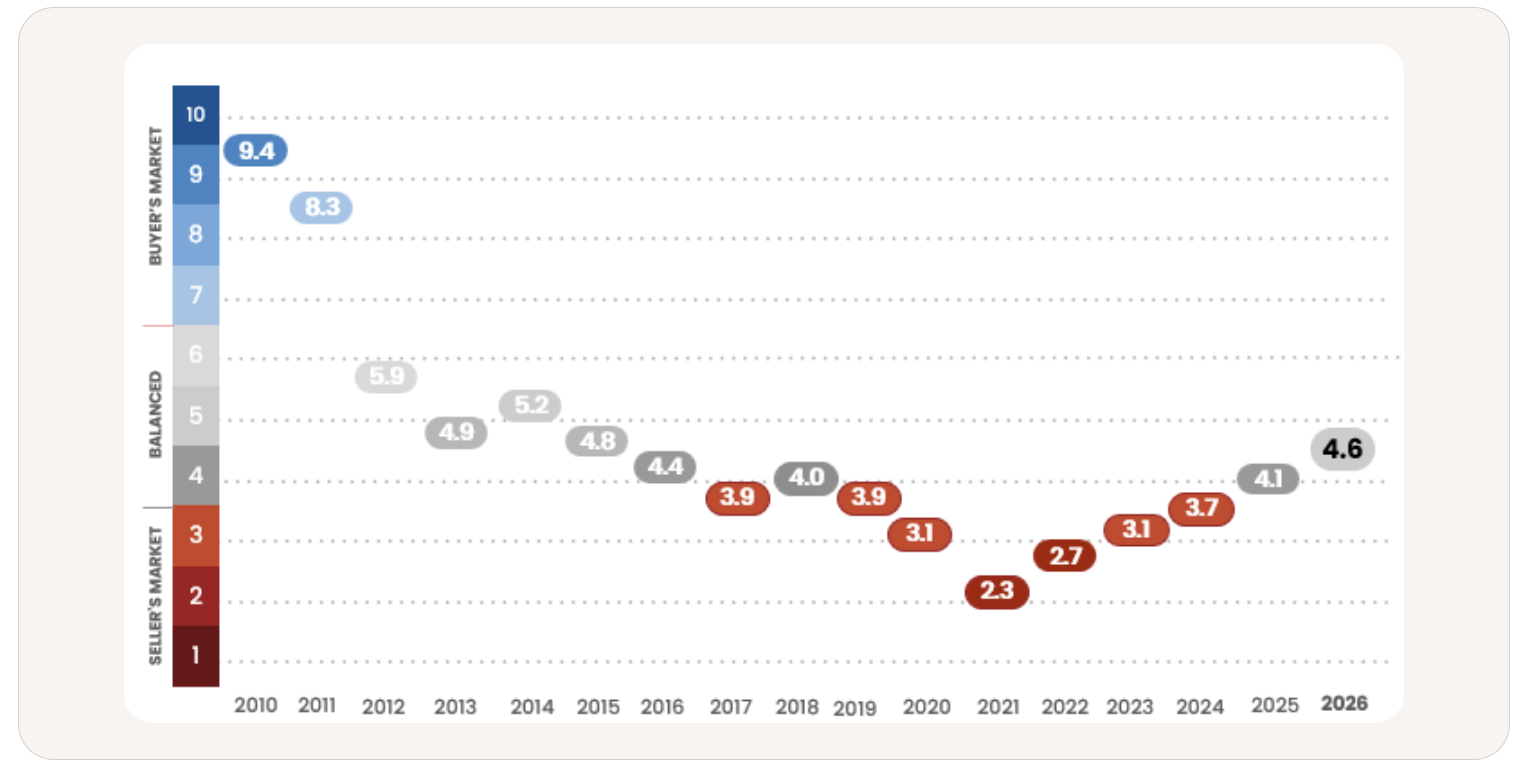

The Phoenix real estate market is heading into 2026 with a very different feel than the frenzy of previous years. According to the latest Realtor.com® Housing Forecast, the national market is settling into a more balanced rhythm and Phoenix is no exception.

Mortgage rates are stabilizing, inventory is rebuilding, and pricing pressure is easing. This doesn’t mean the market is weak. It means it’s more strategic. And strategy favors informed buyers, prepared sellers, and disciplined investors.

Here’s what the 2026 housing outlook means specifically for Phoenix and the surrounding Valley.

Phoenix Home Prices in 2026: Modest Adjustments, Not a Crash

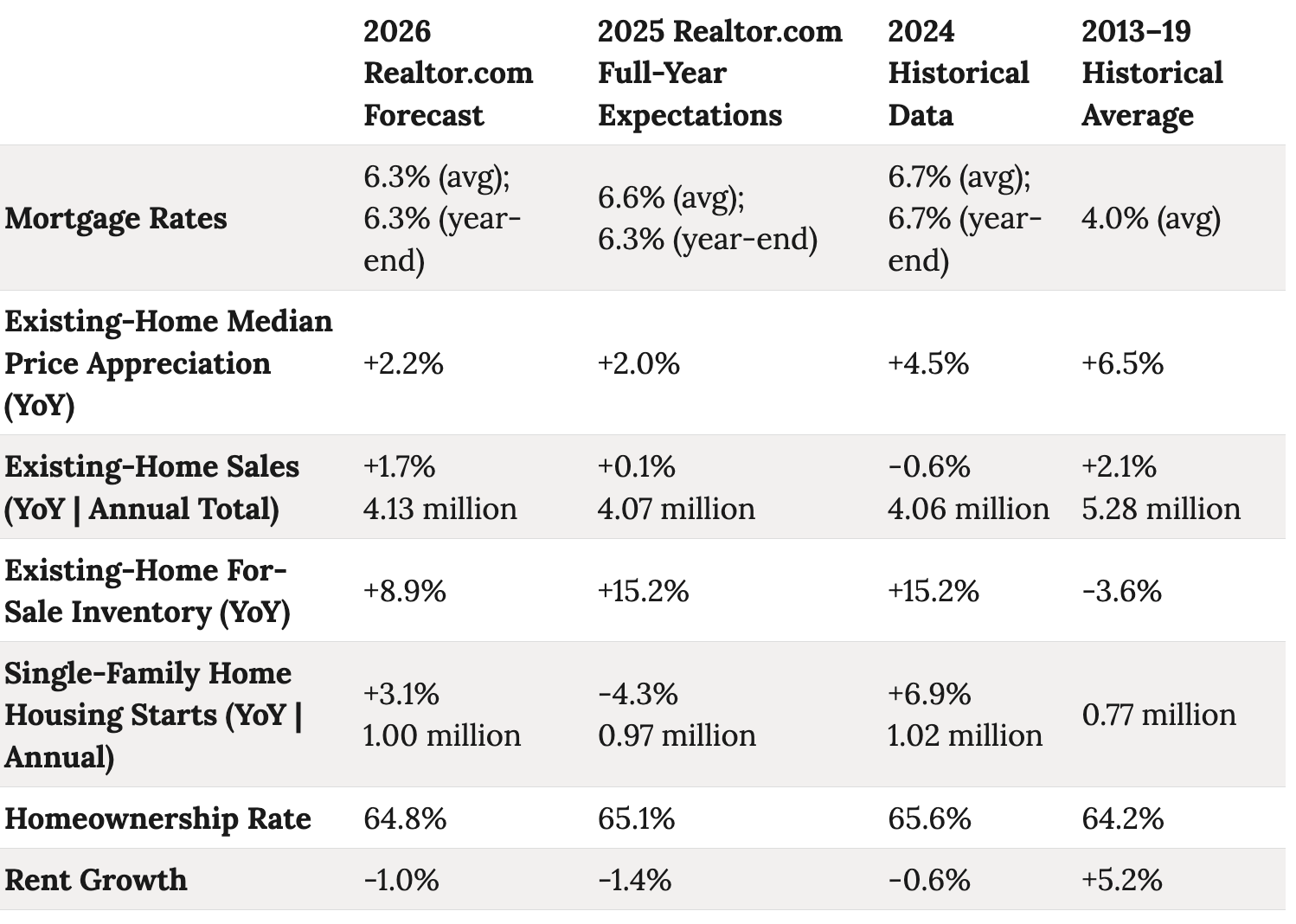

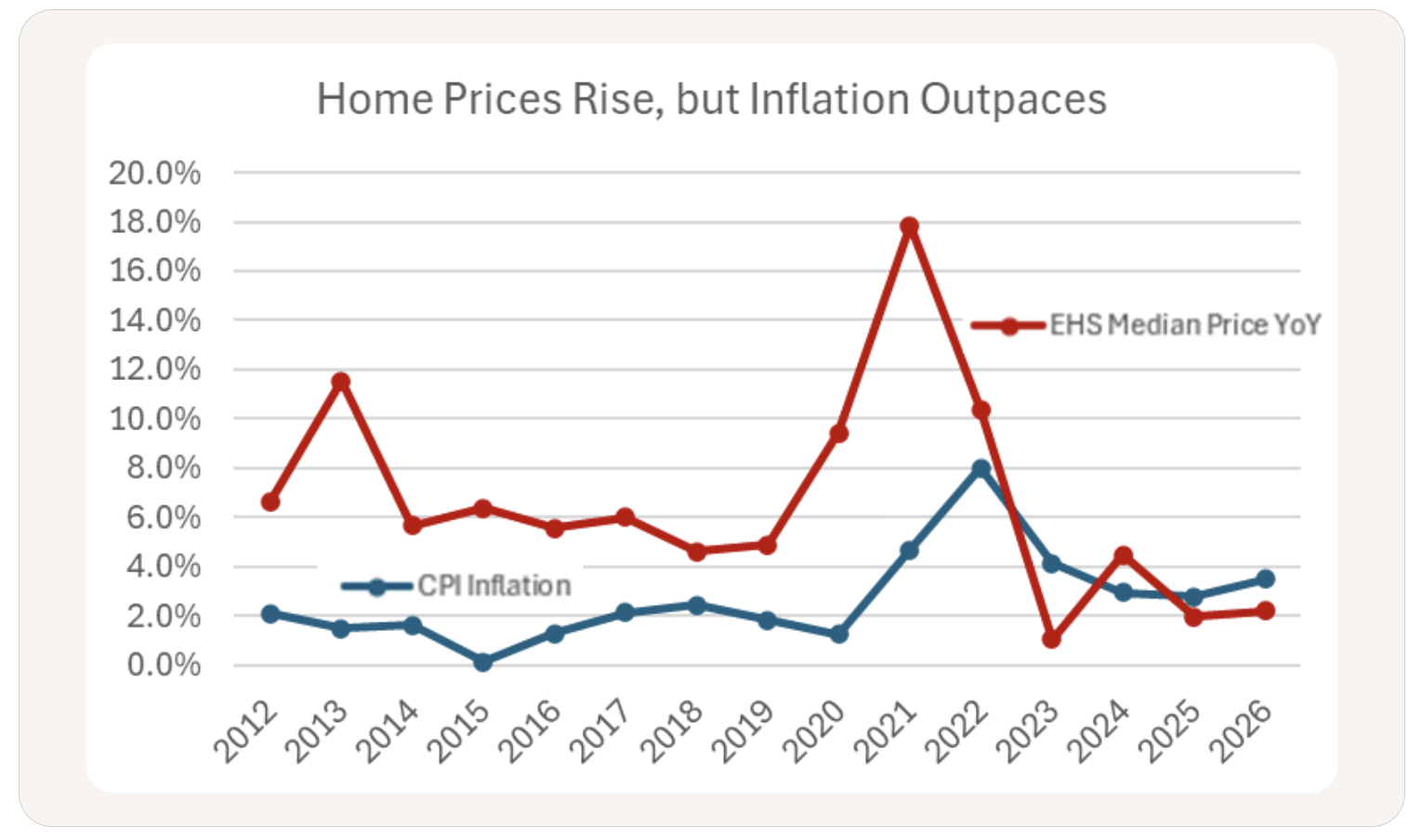

Nationally, home prices are projected to rise about 2.2% in 2026. In contrast, the Phoenix–Mesa–Scottsdale metro is forecasted to see prices dip approximately 2.3% year over year.

That doesn’t signal a collapse, it reflects normalization after years of rapid appreciation.

For Phoenix homeowners, this means:

- Pricing matters more than ever

- Overpriced homes will sit longer

- Well-positioned homes will still sell

In real terms (after inflation), prices are expected to soften slightly nationwide, which quietly improves affordability even when sticker prices don’t feel cheaper.

Translation: The market is recalibrating, not retreating.

Mortgage Rates and Affordability: A Breather for Buyers

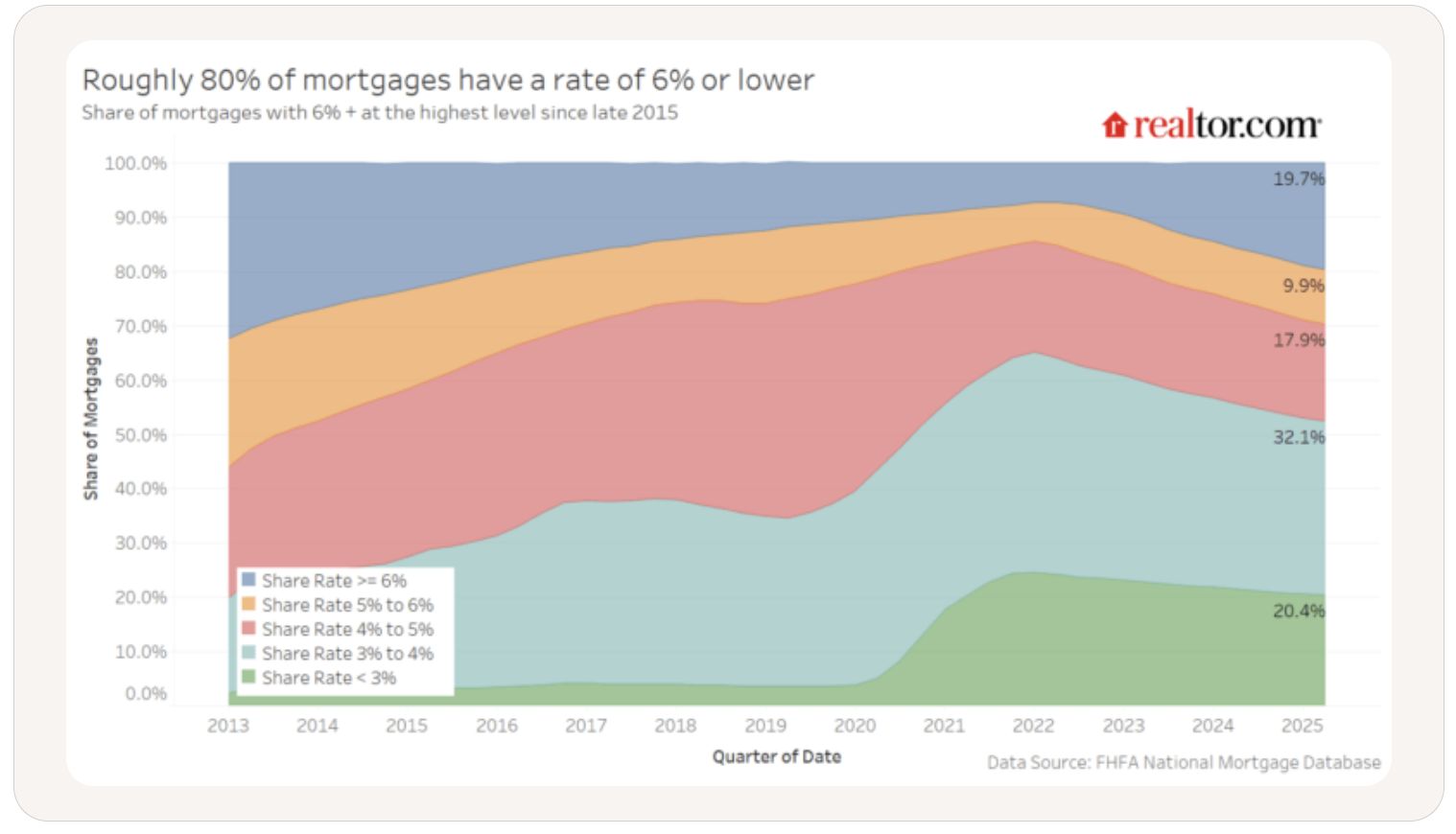

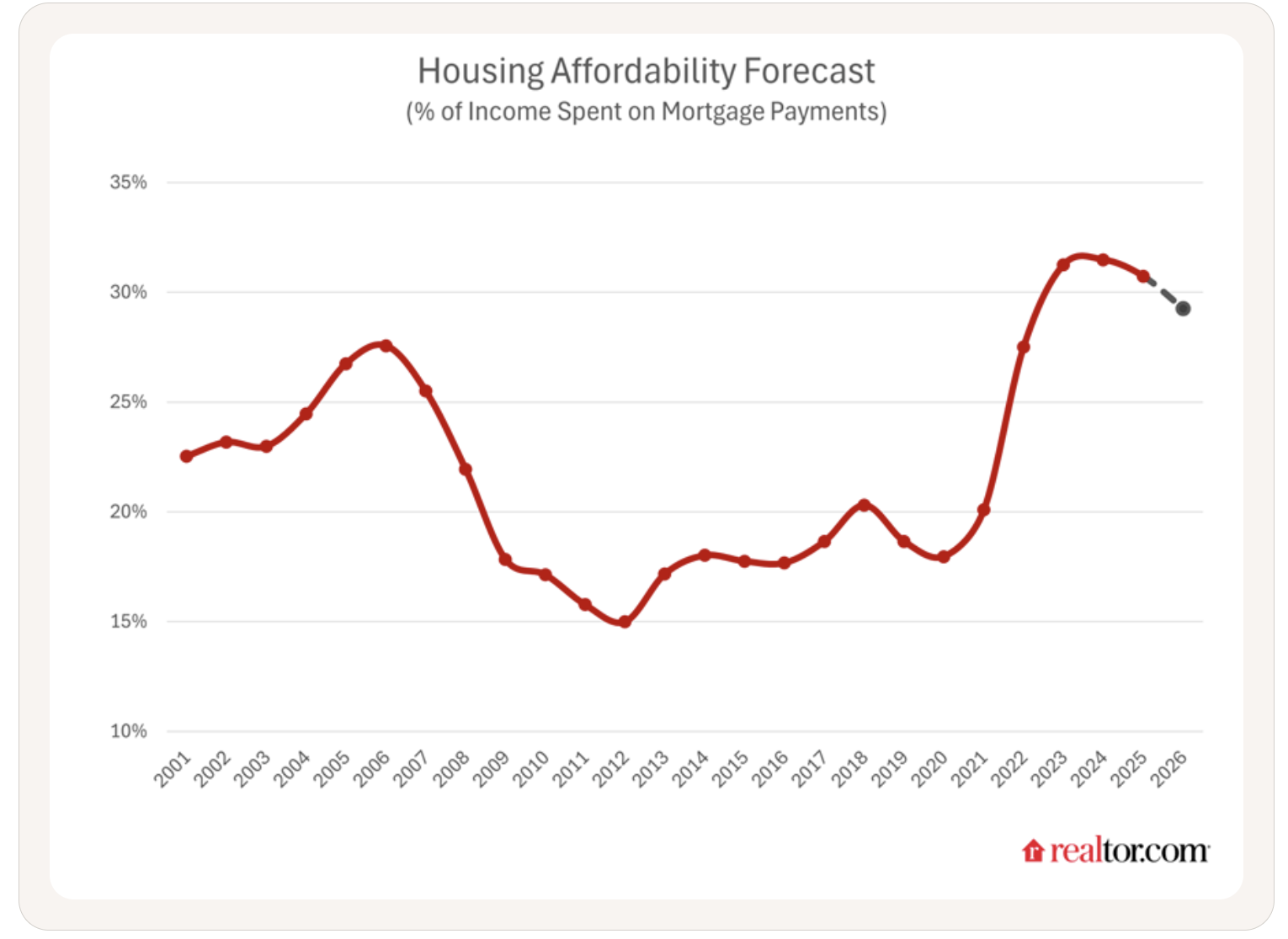

Mortgage rates are forecast to average 6.3% throughout 2026, down from 2025 averages. While that’s not “low” by historical standards, the consistency matters.

Combined with slowing price growth and rising incomes, affordability is expected to improve:

- Monthly payments are projected to decline slightly year over year

- Housing costs are expected to fall below 30% of median income for the first time since 2022

For Phoenix buyers, especially move-up buyers and first-timers, this creates a narrow but meaningful window to re-enter the market with leverage.

Inventory in Phoenix: More Choices, More Negotiation

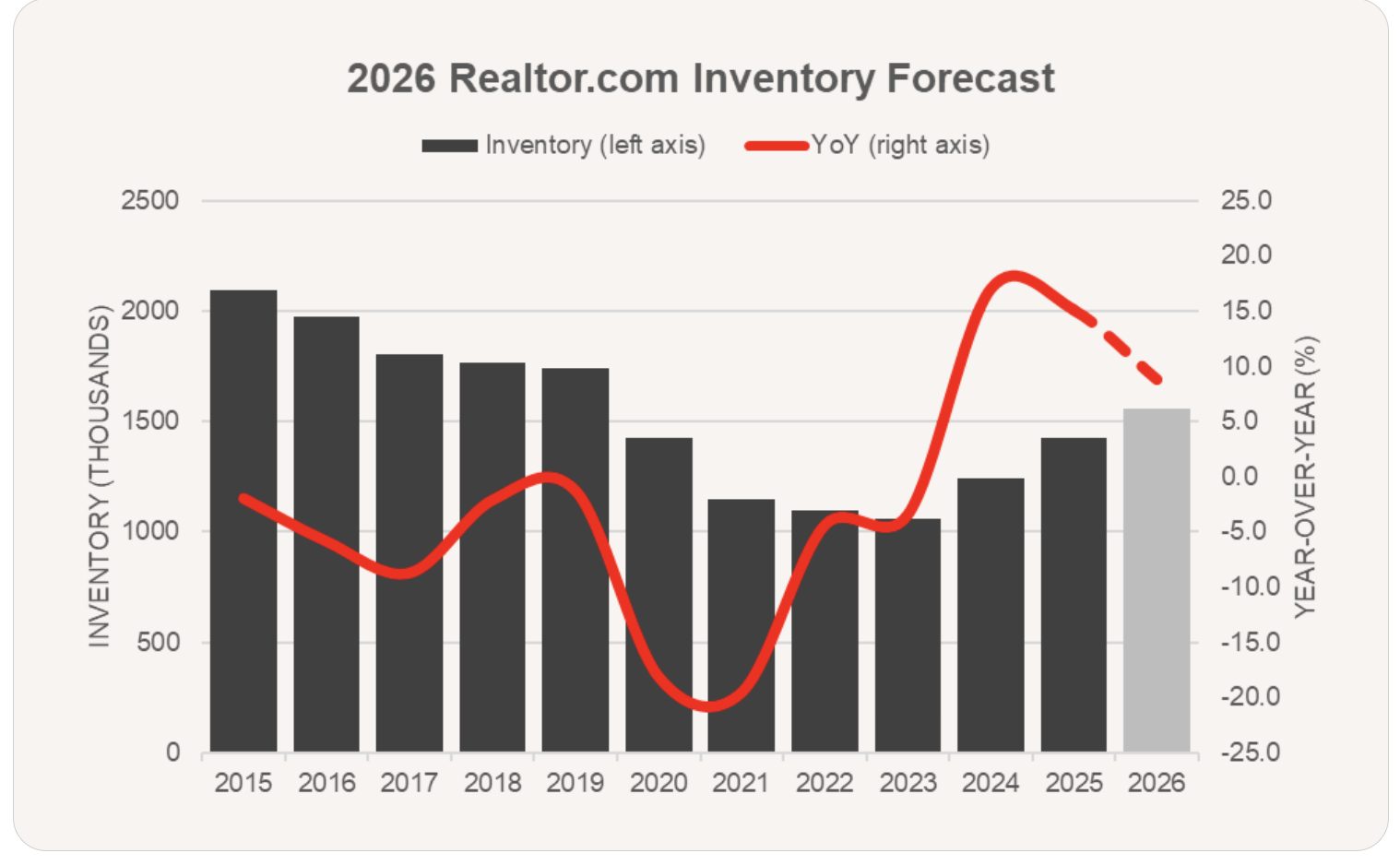

National housing inventory is projected to grow nearly 9% year over year in 2026. Phoenix has already been ahead of this trend, and that momentum is expected to continue.

What this means locally:

- Buyers will see more homes to choose from

- Sellers face more competition

- Negotiations are becoming normal again

We’re no longer in a market where the first offer wins by default. Buyers are asking for:

- Price adjustments

- Seller concessions

- Repairs or credits

And sellers who respond strategically are the ones getting deals done.

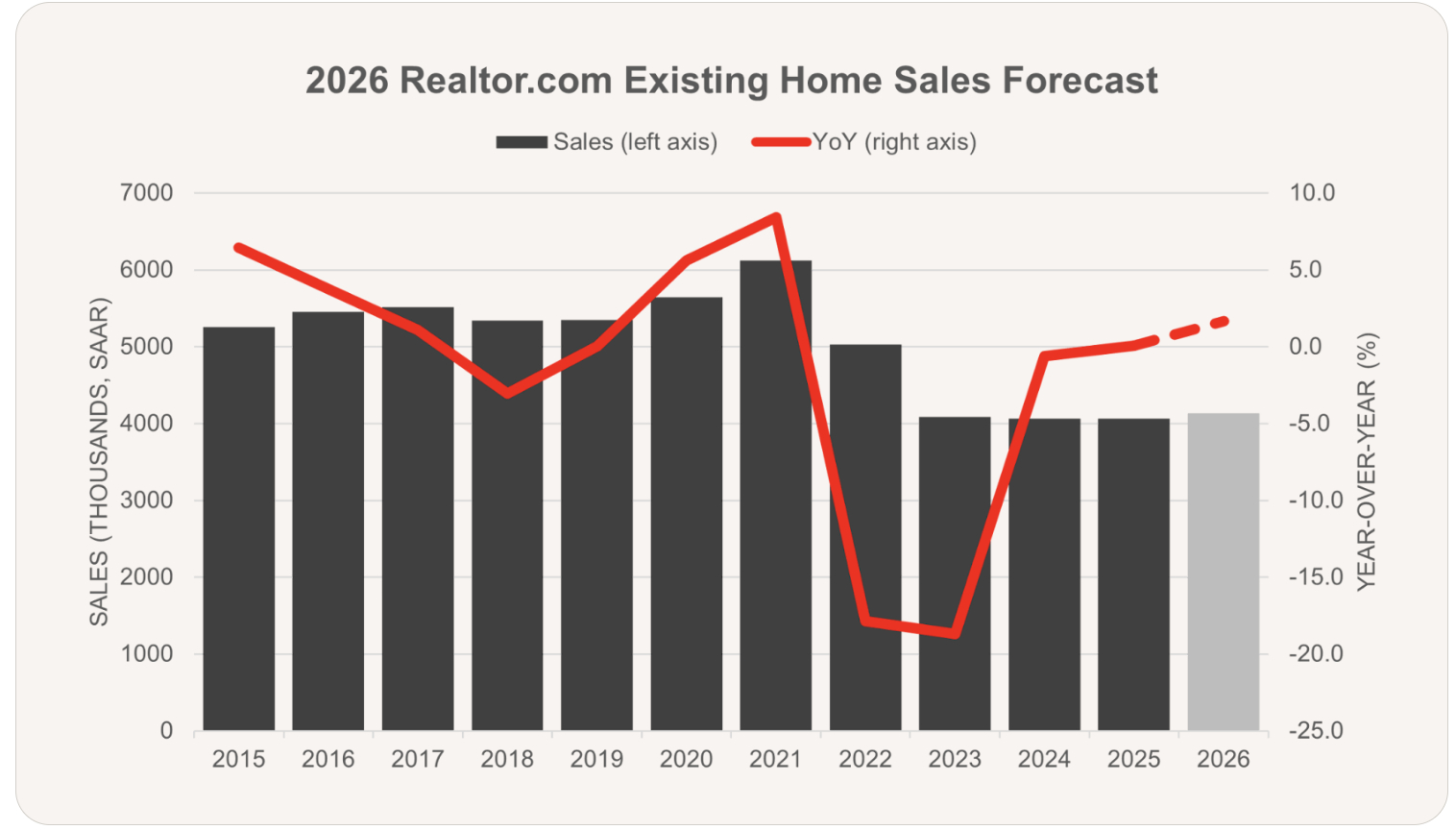

Home Sales: Activity Improves, But Selectively

Existing home sales are projected to rise modestly nationwide in 2026. In Phoenix, sales volume is expected to increase even as prices soften, an important signal.

This tells us:

- Buyers are active, just cautious

- Homes that are priced correctly still move

- Motivation matters more than timing headlines

The long-standing “rate lock-in” effect remains real, but life events, job changes, family needs, lifestyle shifts, continue to drive transactions.

New Construction: A Major Factor in the Valley

One of the biggest influences on the Phoenix housing market is new construction.

Builders across the Valley are:

- Offering mortgage rate buydowns

- Providing closing cost incentives

- Competing directly with resale homes on price per square foot

For buyers, new builds can offer better affordability on a monthly basis, even if the purchase price looks similar.

For resale sellers, this means:

- Presentation and pricing must compete with incentives

- Smaller or well-updated homes perform best

Entry-level inventory remains in demand

Phoenix Investors: A Market That Rewards Discipline

Investors remain active nationwide, accounting for more than 1 in 10 home purchases. In Phoenix, the focus is shifting from appreciation to fundamentals.

Smart investors are prioritizing

- Cash flow over speculation

- Rent-ready properties

- Submarkets with long-term employment growth

With rents softening slightly and inventory expanding, 2026 favors investors who buy right, not fast.

What This Means for You

If You’re Buying:

- You have more negotiating power than in recent years

- New construction incentives can dramatically change affordability

- Preparation beats waiting

If You’re Selling:

- Pricing strategy matters more than timing the market

- Condition, location, and competition determine results

- Flexibility wins

If You’re Investing:

- Phoenix remains a long-term growth market

- Conservative underwriting is essential

- Opportunities exist, but only with precision

Final Thought: Phoenix Is a Strategy Market in 2026

The 2026 housing market isn’t about chasing headlines or timing the bottom. It’s about understanding local data, market balance, and leverage points.

Phoenix isn’t overheating.

Phoenix isn’t collapsing.

Phoenix is maturing.

And in markets like this, the advantage goes to people who move with clarity.

If you want to know how these national trends apply to your specific neighborhood, price point, or timeline, that’s exactly where local expertise matters most.